PFAS: Nine key headlines emerge from ECHA’s proposed restriction

A new proposed restriction under the REACH Regulation has implications for the use of around 10,000 per- and polyfluoroalkyl substances (PFAS), both in and beyond the EU. These fluorinated substances, including non-polymers and polymers, are the subject of global regulatory scrutiny, with new regulatory measures recently introduced in the USA. However, the proposed EU PFAS restriction goes much further.

PFAS restrictions: key headlines

While the information behind the proposals is extensive and will need to be evaluated carefully for each substance and use, some headlines are clear.

- Minimal delay: The proposal entails a full ban 18 months after the restriction enters into force. Some use-specific derogations are included to allow time for society to adjust to the effect of the ban, and they are purposefully well-defined and limited to avoid shifting the cost burden arising from health and environmental impacts to future generations.

- Broad scope: As expected, the restriction aims to address a very wide number of PFAS. Substances within scope of the restriction include any that contain at least one fully fluorinated methyl (-CF¬3-) or methylene (-CF2-) carbon atom. That means at least one such fully fluorinated atom which has no directly attached hydrogen, chlorine, bromine or iodine. The definition encompasses fluoropolymers and fluorinated gases (F-gases). Only a few PFAS that are expected, based on specific structural characteristics, to completely mineralise in the environment are excluded from the scope of the restriction.

- Impact across sectors and supply chains: The proposal is remarkably broad and covers all stages of the supply chain. Only a few highly-regulated uses will be exempt. It would cover the manufacture, importation, supply and use of PFASs on their own, as well as placing them on the market as a constituent in another substance, in a mixture or an article.

- Concentration limits: The restriction would apply several specific concentration threshold limits – 25ppb for an individual PFAS, 250ppb for the sum of PFAS and 50000ppb for polymeric PFAS. Only PFAS present in substances, mixtures and articles under these limits could be placed on the market.

- Derogations in special cases: The ban would come into effect 18 months after the restriction enters into force. This is extended for certain uses of PFAS mainly based on understanding of the availability and applicability of alternatives to PFASs. For example, for fluoropolymers and perfluoropolyethers a 5-year derogation after entry into force is indicated for use in food contact materials (FCMs) and a 12-year derogation after entry into force is indicated for certain medical devices and equipment. Other uses of PFAS in general that may benefit from a temporary stay of execution for PFAS include certain refrigerants, textiles used in PPE, and specific industrial applications.

- Need for better evidence: Some additional use-specific derogations for which the existing evidence base is weak are marked for further reconsideration following the public consultation. These derogations will only be considered justified if substantial evidence to that effect is provided, highlighting the importance of those involved in these sectors engaging in the public consultation, as discussed below.

- Exemptions: Only active substances in biocidal products, plant protection products and human and veterinary medicinal products are specifically exempted. Other more general exemptions in REACH will continue to be applicable, such as exemptions for non-isolated intermediates, dangerous goods in transit, waste, and the use of substances in scientific research and development.

- Reporting obligations: Businesses taking advantage of the exemptions for active substances in biocides, PPPs and medicines or the use-specific derogations would still face biennial or annual reporting obligations respectively, keeping these uses firmly on ECHA’s radar.

- Site-specific management plans: The restriction as foreseen also has some novel edges, consistent with a very proactive approach to managing persistent substances in the EU. As well as mandating reporting to the authorities in certain situations, it would introduce a requirement for importers and downstream users of fluoropolymers and perfluoropolyethers making use of derogations to include a site-specific management plan justifying use and conditions of use and safe disposal. Manufacturers and importers of PFASs or PFAS containing articles as well as formulators of PFAS containing mixtures would attract additional annual reporting obligations.

What to do next

Given the widespread use of PFAS across many sectors, this far-ranging restriction will have impacts for most businesses. Determining where PFAS are supplied and used in the supply chain will be paramount. Manufacturers, importers and downstream users of substances and articles and formulators of mixtures alike will need reliable and sufficient information from their supply chain to ensure compliance. For many, identifying feasible alternatives will be challenging.

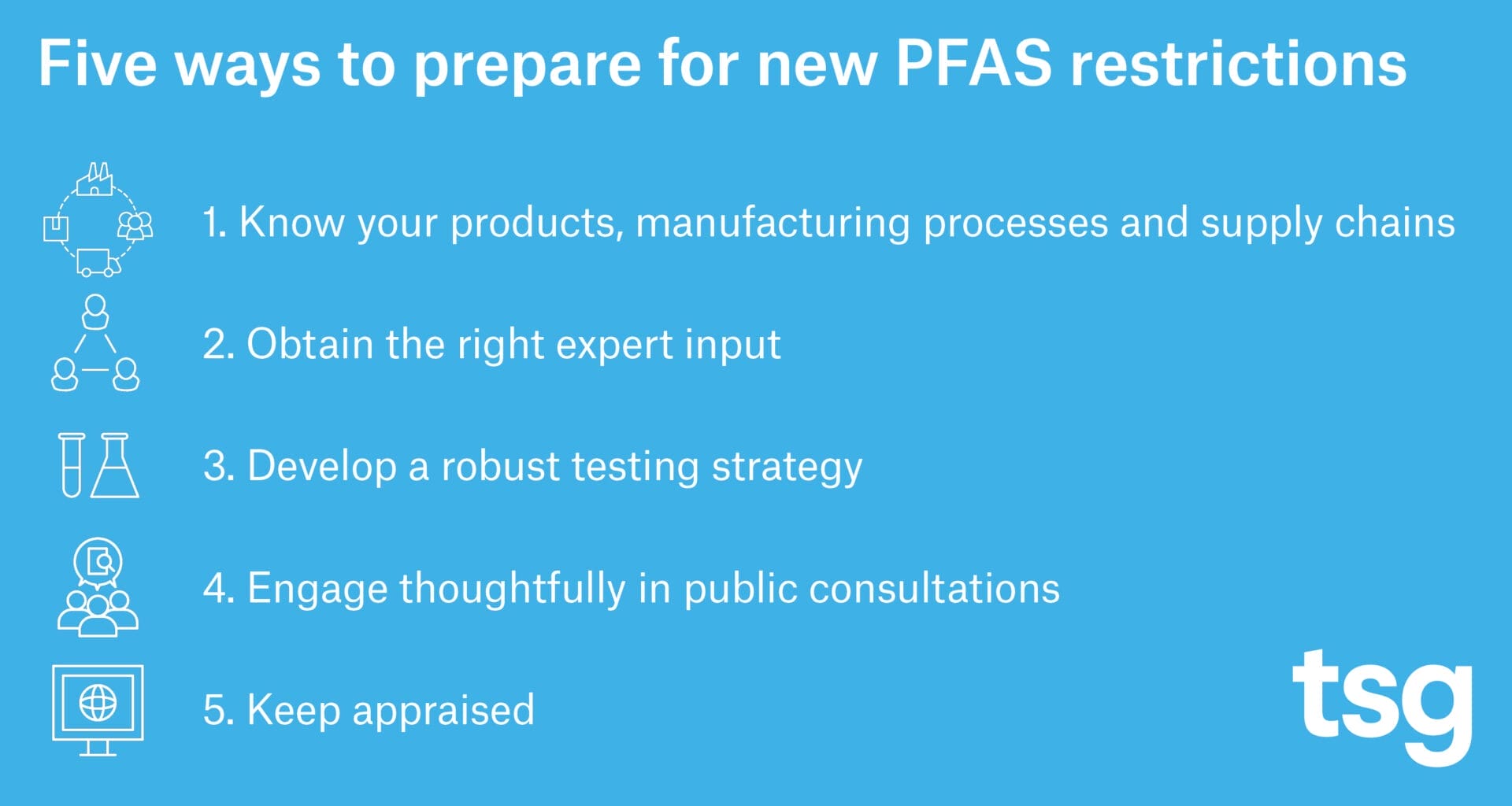

A six-month consultation is currently planned to start on 22 March 2023. Comments received during consultations will be considered by the scientific committees during their opinions on the proposals. Our recent article in Chemical Watch and advisory to clients outlined five ways to prepare for the new PFAS restrictions, encouraging organizations to engage thoughtfully in the public consultation process. You can read the full article here: Forever chemicals: how to get ready for the new PFAS restriction.

Now is the time to prepare. TSG Consulting can support companies across industry in understanding the implications of the proposed ban, as well as preparing comments for submission to the consultation. Get in touch at [email protected] to speak with our team.